Introduction

The COVID 19 pandemic together with the resulting forced economic shutdowns have created far-reaching, but disparate impacts on commercial real estate.

As the team and I look back on the last several months of this unprecedented pandemic, we note several observations with respect to the performance of the commercial real estate sector. While we are seeing some challenges in various sectors of the market, the overall resilience to date has been reassuring. In the early months of this pandemic we advised our clients to be pro-active on collections, conservative (cautious) on new capital or operating expenditures, and patient with respect to investing in new opportunities. Four of our senior leaders at Trinity have experienced multiple recessionary periods in commercial real estate, what we like to call “cycle tested.” We know that the early days of a downturn are when this combination of action, caution, and patience is critical. It also means to maintain perspective, avoid panicky decisions and think long-term.

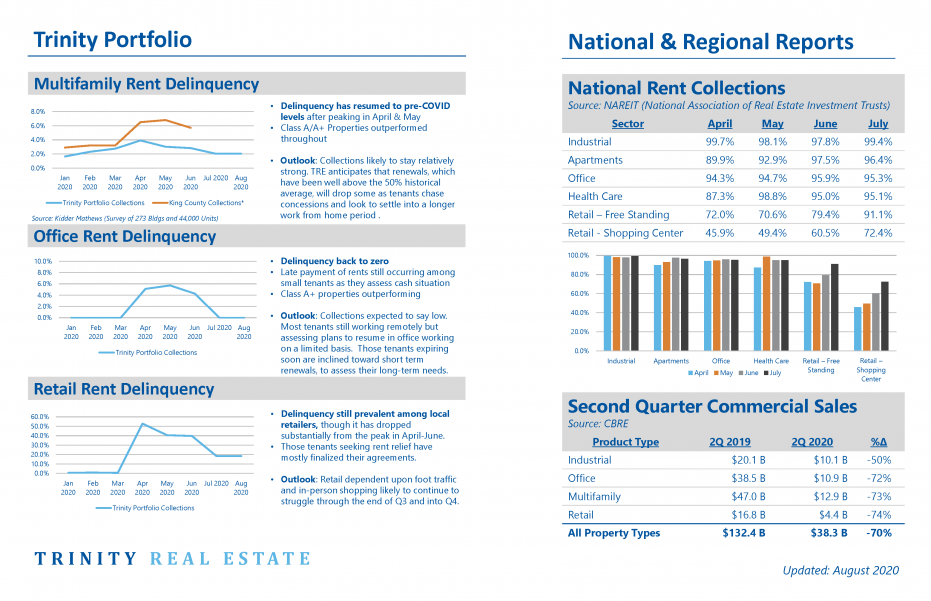

As you may imagine, the transactional side of our business has been (intentionally) quiet since the onset of the pandemic. This is demonstrated by lower national commercial real estate sales transactions in the second quarter of this year versus the same period of a year ago.

In contrast, our advisory work has picked up substantially as our current and new clients are looking for support to minimize financial and operations exposure(s), and to take appropriate steps to preserve the performance of their current commercial assets. Safety is top of our mind for us and our clients as people begin to return to their office. We have been working with industry experts and our clients to determine the optimal cleaning and environmental requirements to provide a safe working environment.

In turn, we are also actively working to position these assets for success in the post-pandemic environment while at the same time determining when they should be enhanced or adjusted in order to provide greater portfolio diversification.

The COVID 19 pandemic together with the resulting forced economic shutdowns have created far-reaching, but disparate impacts on commercial real estate. These range from accelerating demand (e-commerce distribution) to outright abandonment (convention hotels) and a range of impacts between the two. Following are our thoughts on the current state of the commercial real estate market and Trinity’s activities broken down by subsectors.

Multifamily

Overall, we are still a strong believer in the long-term attractiveness of this multifamily sector, but have added some new considerations in their management and selection.

At Trinity, we have been a consistent proponent of owning multifamily properties of high quality that are in great locations with strong demographics. We believed at the onset of the pandemic that “A” multifamily locations would experience less hardship with rent collections. In large part this has proven correct, well located properties nearby major growth employers (primarily technology companies), have retained well-employed residents who maintain timely payment histories. Those properties in more affordable settings serving workforce housing and the service sector have seen much greater challenges on collections. The trailing table statistics show the trend to date.

From a specific urban perspective, the cities of Seattle and Portland are experiencing some very acute political and civil unrest that is causing us and our clients concern. Furthermore, the significant cost to build urban rental properties has recently led to a trend towards smaller unit sizes. These smaller footprints are more challenging for the work-from-home employees. Both these elements are creating a new dynamic of consideration for current and future multifamily investments. As noted below in our discussion of future office utilization, a worker’s residence (and its size and configuration) may see a shift to accommodate more office-type use and functionality.

Over the last couple of months, we have seen a short-term shift away from the urban core, which is starting to cause increases in vacancies and concessions. We believe this trend is short-term as renters will likely move back to the urban areas and their associated amenities post COVID 19. We have been working with our property managers to focus on occupancy and cash flow. We have also advised our clients to be cautious with major renovations. Overall, we are still a strong believer in the long-term attractiveness of this multifamily sector, but have added some new considerations in their management and selection.

Industrial

We expect interest in distribution and warehouse space to persist as e-commerce's market share continues to grow. The increased demand, combined with low vacancies and limited land inventory has caused limited new supply.

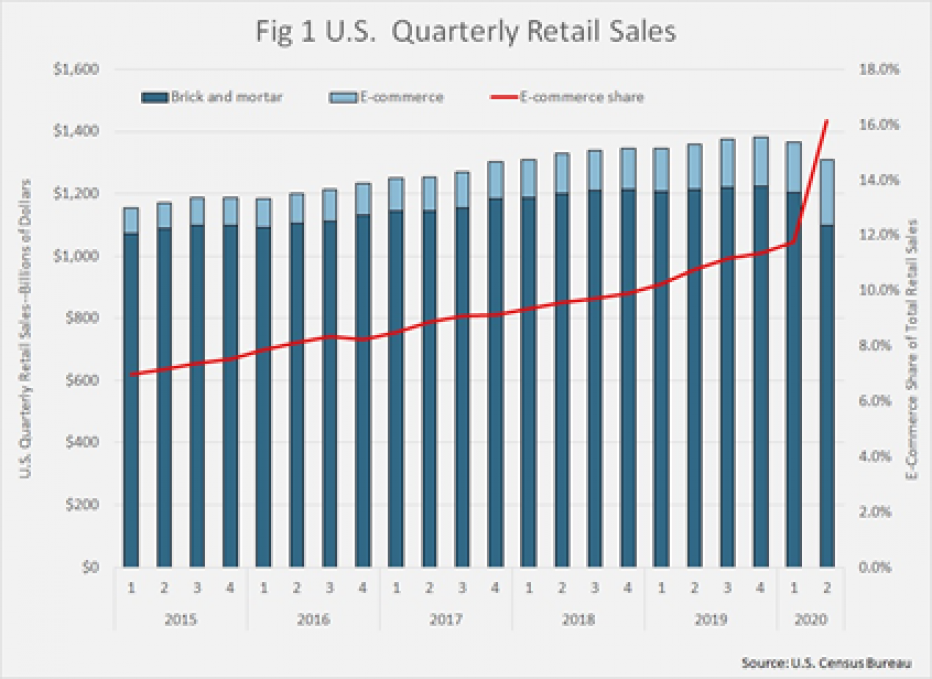

The pandemic and associated “shelter in place” orders have further accelerated the shift in consumer buying behaviors from bricks-and-mortar stores to the convenience of online shopping. Internet sales as a percentage of total retail sales is up dramatically (moving from 12% to over 16% of total sales in the second quarter). While the trend itself may temper somewhat, we believe the shift is here to stay, and the result is a continued push for industrial space near urban centers that support “direct-to-consumer” deliveries.

We have spoken for some time about the interest in “last mile” locations for industrial properties. The “last mile” means distribution properties located close to urban centers, often with smaller footprints, that allow for ease of rapid delivery of products directly to customers in their homes. The appetite for warehouse space of this nature has been apparent from recent leasing activity among e-commerce tenants (Amazon is the biggest driver). The demand for larger, distribution hubs that are proximate to the major urban areas has also continued unabated.

We expect interest in distribution and warehouse space to persist as e-commerce's market share continues to grow. The increased demand, combined with low vacancies and limited land inventory has caused limited new supply. This limited supply has naturally led to strong investment performance. We anticipate that this imbalance between supply and demand to continue for the foreseeable future. In the last couple of months, we have advised several clients on the valuation and optionality of their industrial properties.

Office

On balance we believe that office spaces in the future will likely have fewer full-day occupancy desks per employee and have a greater demand for interactive and collaborative spaces.

In the office sector, we see two competing (and somewhat offsetting) impacts to demand from the COVID 19 experience. The first is a likely reconfiguration of office desks to allow for greater distancing. All things being equal, such a greater distancing between workers would expand office demand and offset a now decades-long trend of office workers using (on average) less space. This shift, however, may be temporary. A stronger and secondary trend is the realization that many workplace tasks and processes can be done remotely from employees working from home. On balance we believe that office spaces in the future will likely have fewer full-day occupancy desks per employee and have a greater demand for interactive and collaborative spaces.

A recent McKinsey & Company review indicated the percentage of time worked in the office will decline (9-12%) while working from home will increase from 20% to 27%.[1] On a somewhat more subjective basis, a recent survey by KPMG indicated approximately 70% of surveyed executives predicted they may reduce their office footprint in the future. However, we also note the Federal Reserve Bank of Atlanta conducted a survey this past June[2], which indicated 80% of the respondents anticipated no change to their office needs after the pandemic subsides. Of the 20% who felt otherwise, it was evenly distributed between those anticipating more space and those anticipating less.

These conflicting data points are not all that unusual when trying to define what the future holds. A shift to considerably lower-density office occupancy will likely expand demand for space. However, most companies, we believe, will realign through increased working from home and split team occupancy in the office. While there will be a shorter term “pause” on office demand and a small reset on average occupancy per employee, we believe office demand will resume, with a preference for flexible configurations.

Specifically, the Seattle/Puget Sound office vacancy rate has remained healthy. However, the market experienced an increase in sublease vacancy and a drop-in leasing activity in the second quarter of 2020. The impact of the COVID 19 pandemic was felt immediately as reflected in total leasing volume, which is down 56% compared to Q2 2019. However, the vacancy rate remains healthy.

Trinity’s portfolio has not seen significant office rent delinquencies. However, we are seeing and experiencing an increase of short-term renewals with our clients' office assets. The tenants with impeding lease expirations and firms that were in the market for additional office space, are executing discounted short-term renewals as a temporary stopgap for their needs. This is an industry wide trend as many office users are contemplating their path forward. Some tenants, however, have made significant bets in their office space, as demonstrated by Amazon recently signing up for over 2 million square feet of new leases in Bellevue and Facebook acquiring REI's headquarter space also in Bellevue.

While work from home orders and, to a lesser extend, civil unrest has put some near-term pressure on urban, transit-served office markets we believe it will eventually return to normalcy. The young, urban-dwelling, creative-class technology employees living preference will continue to fuel the urban office market for the long-term.

Trinity’s portfolio has not seen significant office rent delinquencies. However, we are seeing and experiencing an increase of short-term renewals with our clients' office assets.

[1] “Reimagining the office and work life after COVID-19”, McKinsey & Co., Boland, Smet, Palter, and Sanghvi, June 2020.

[2] Survey of Business Uncertainty, Federal Reserve Bank of Atlanta, June, 2020.

Retail

Dramatic and systemic changes are occurring within the retail sector.

Growth of e-commerce and the pandemic dynamics has put significant pressure on the retail industry nationwide. Our Trinity dashboard below shows that retail rent delinquency continues to grow throughout this pandemic period. Dramatic and systemic changes are occurring within the retail sector. In any time of change, opportunities will rise to the top and as such we are keeping a close eye on the developments occurring within this sector. Not surprisingly, some segments are doing well. Home improvement, grocery stores, specialty foods, and certain others have seen sales gains. Most segments, absent a robust online presence and effective delivery mechanism, have been hit hard.

Recently, we have worked with a number of our retail tenants to negotiate rent deferment. We have also been working proactively with our clients who have retail exposure to consider the optionality of their space. For example, we are working with a client to consider reducing an oversized first-floor restaurant space and converting a portion into small office space, which we believe will lease quickly given its prime location.

Hospitality

As a result of the significant duress in this sector, there are likely to be buying opportunities relative to historical price points.

The dramatic drop-off of travel and the replacement of in-person meetings with online connections have created a significant downturn of occupancy for hotels. In the early stages of the shut-down, many large, convention-oriented hotels were down to single-digit occupancies, with several closing down altogether. While some travel has returned (as has hotel occupancy), the sector in general continues to struggle with very limited traffic. CBRE’s hotel group is anticipating a very slow and lengthy recovery, with occupancies and room rates not returning to pre-COVID 19 levels until 2023-24.

As a result of the significant duress in this sector, there are likely to be buying opportunities relative to historical price points. Hotel ownership, however, requires a good understanding of the hospitality business metrics and the higher volatility associated with daily bookings. We note two of our senior partners here at Trinity have extensive experience in purchasing and managing hospitality properties. Prior to acquiring a hospitality asset, we recommend the investment profile of this opportunity needs to be carefully understood, and precisely align with a client’s risk tolerance and capabilities in order to create a successful match to an overall portfolio strategy.

Debt Market

Unlike the great recession of 2008-2010, which caused a drop in liquidity throughout the banking sector, banks today are in relatively strong financial condition. At the commencement of the pandemic, we saw many banks openly working with borrowers that were having issues. Many offered deferments or eliminations of principal payments and sometimes both principal and interest payments for a period of time.

As the pandemic continues, we expect this initial period of cooperation to drop as lenders feel the need to protect their positions. Currently, our clients don’t have any significant debt pressures, primarily as a result of our recommendation to only borrow modestly. We generally recommend that if there are loan issues with assets, its best to communicate with your lender early so that they have confidence that you have a plan to protect their collateral.

For new borrowing, we note that most banks have become more conservative, looking to lend on assets with strong consistent cash flow and with good sponsors. Assets with any “hair” such as vacancies or an environmental condition will be much harder to finance. While interest rates have dropped to very attractive levels, loan amounts have been reduced, and the number of assets banks are willing to lend on have also shrunk. To fill the void, we expect an overall increase in new debt funds to finance the perceived increased in distressed buying opportunities.

Recently, our senior managing partner, Pete Stone, completed a webcast with one of our debt partners in the marketplace, The Commerce Bank, where they discussed the debt market. Here is a link to this webcast.

Summary

We are still very positive about the marketplace for new commercial real estate assets despite the challenging dynamics caused by this pandemic. We note that our current assets are performing well on a relative basis. In large part this is reflective of having a well located and diversified commercial real estate portfolio to help cushion and offset impacts in an economic downturn. We continue to advise action, caution, and patience with the expectation that opportunities will develop.

Our mission is to assist our clients in developing a tailored real estate portfolio to meet their goals of preserving, enhancing, and creating wealth. Please feel free to reach out to me or any of my partners with questions or needs.