YOUR REAL ESTATE WEALTH MANAGER

Institutional Expertise to Guide Your Real Estate Investing

Trinity partners with family offices and institutional investors to deliver expert real estate asset management, resilient portfolios, and long-term value.

- $8B+ Collective AUM*

- 40+ Families & Institutions Served*

- 32 States Covered*

WHY TRINITY

Since 2001, Trinity Real Estate has served as a trusted advisor and execution partner for high-net-worth individuals, multi-generational family offices, and institutional investors navigating complex commercial and multifamily real estate strategies. Our integrated platform combines institutional-grade precision with family-first alignment, offering capital deployment, portfolio reviews, and long-term advisory.

Clients turn to Trinity for real estate portfolio optimization, joint venture structuring, and capital allocation strategies aligned with both performance goals and legacy planning. From succession and governance to multigenerational mentorship, we support families and institutions at every stage of the real estate lifecycle. Grounded in fiduciary discipline and driven by data, we build enduring value across market cycles.

Learn More About Us

WHO WE SERVE

We are committed to the long-term creation, enhancement, and preservation of real estate wealth on behalf of our clients through disciplined strategy, market insight, and proactive asset management.

FAMILY OFFICES & HNWI

Whether navigating a liquidity event or structuring an intergenerational legacy, we partner with family offices to integrate investment strategy, estate planning, and governance with precision and discretion.

Read more

Institutions

From performance benchmarking to co-investment structuring, we support institutions seeking risk-adjusted returns through high-quality real estate portfolios, development ventures, and market intelligence.

Read more

Advisors & Consultants

We collaborate with wealth managers, attorneys, CPAs, and family office consultants to act as a seamless extension of the advisory team, translating complex objectives into clear, actionable real estate outcomes.

Read more

EXPERTISE & SERVICES

Trinity Real Estate provides end-to-end real estate solutions for high-net-worth individuals, family offices, and institutional investors. From strategy to execution, our integrated platform is built to preserve generational wealth, enhance real estate portfolio performance, and uncover institutional-grade opportunities in every market cycle.

View All ServicesStrategic Advisory

Our advisory services empower families and institutions with data-driven guidance across all real estate holdings and generational objectives.

- Property & Portfolio Advisory & Review: Real estate portfolio performance review services and asset diagnostics.

- Succession Planning: Generational wealth transfer planning for real estate assets, leadership alignment, and continuity strategy.

- Investment Strategy Development: Capital allocation strategies and risk tolerance modeling tailored to investment priorities.

- Family Education & Mentorship: Cross-generational engagement and real estate fluency-building to support lasting governance.

Portfolio & Asset Management

Long-term performance starts with disciplined oversight.

- Portfolio Creation: Commercial real estate portfolio creation strategies based on investor objectives.

- Portfolio Management: Ongoing real estate portfolio optimization, rebalancing, and diversification.

- Asset Management: Strategic oversight including leasing, capital planning, and institutional-grade reporting and benchmarking.

Transaction Services

Execution matters. We offer white-glove guidance through every stage of the deal lifecycle.

- Acquisitions: Real estate acquisition services, due diligence, and deal structuring.

- Dispositions: Real estate disposition strategies and exit planning aligned with tax objectives.

- 1031 Exchanges: Full-service 1031 exchange planning, compliance, and execution.

- Ground Leases: Structuring and negotiating ground lease transactions for long-term value creation.

- Financing Solutions: Investment property financing and capital structuring through a vetted network of lenders.

Project Development

From entitlement to execution, we provide institutional discipline across development cycles.

- Development Evaluation: Real estate development feasibility studies and underwriting.

- Development Management: Oversight of timelines, budgets, and contractor alignment.

- Joint Venture Creation: Structuring strategic partnerships and JV agreements tailored to project needs.

Co-Investment Program

Partner directly with Trinity on institutional-grade opportunities.

Read moreCASE STUDIES

Explore how Trinity Real Estate delivers measurable value through real-world solutions. From strategic acquisitions to succession planning and portfolio optimization, our case studies highlight the impact of tailored execution for family offices and institutional partners.

View All Case StudiesTRINITY’S ADVISORY FRAMEWORK PROCESS

Structured to Align with Your Goals and Deliver Measurable Results

Discovery

-

Clarify investment objectives and risk tolerance

-

Conduct macro and market-specific intelligence gathering

-

Leverage proprietary and third-party data for insight

-

Define project parameters and success criteria

Strategy

-

Design customized investment and operational strategies

-

Prioritize initiatives based on ROI and alignment with goals

-

Develop execution-ready strategic roadmaps

-

Ensure complete alignment with family or institutional mandates

Implementation

-

Execute with precision and accountability

-

Deploy domain-specific expertise across asset classes

-

Coordinate multi-stakeholder execution seamlessly

-

Navigate complexity and adapt to real-time variables

Measure

-

Evaluate performance against defined KPIs

-

Incorporate structured feedback loops from stakeholders

-

Deliver transparent, data-rich performance reporting

-

Optimize strategy through continuous refinement

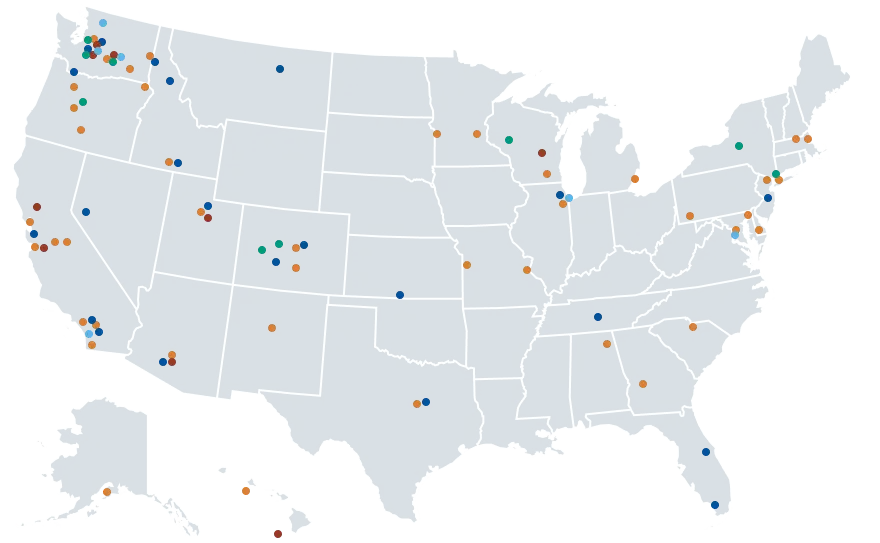

NATIONAL EXPERIENCE ACROSS ALL PRODUCT TYPES

From coast to coast, Trinity Real Estate delivers expert guidance across every major commercial real estate asset class—including office, industrial, multifamily, retail, and hospitality. Our experience spans economic cycles, regions, and generations, helping families and institutions navigate complex transactions and long-term strategy with confidence.

Broad Expertise. Deep Insight.

Whether acquiring stabilized multifamily in the Pacific Northwest, repositioning value-add retail in the Midwest, or advancing family governance and portfolio strategy in the Northeast, Trinity’s national footprint reflects a record of execution powered by data, relationships, and results.

- Office

- Industrial

- Multifamily

- Retail

- Hospitality / Other

CUSTOMER TESTIMONIALS

Hear directly from the families, advisors, and institutions who trust Trinity Real Estate to navigate complex markets, protect legacy wealth, and deliver results with integrity and insight.

FREQUENTLY ASKED QUESTIONS

Find quick answers to the most common questions we hear from our customers.

What is Trinity Real Estate, and how do you serve family offices and institutional investors?

Trinity Real Estate (TRE) is a trusted real estate investment and advisory firm serving family offices and institutional investors since 2001. We offer end-to-end services across real estate acquisitions, development, asset management, and family governance, designed to preserve and grow generational wealth through strategic real estate investing.

What is the minimum investment threshold to engage with Trinity?

We typically partner with clients who have $5 million or more in investable capital allocated to real estate. Trinity offers flexible investment structures including co-investment opportunities, direct ownership, and advisory-only services tailored to sophisticated investors.

What types of real estate strategies do you offer?

We offer a broad range of real estate investment strategies, including core income properties, value-add repositioning, ground-up development, and opportunistic deals. Our approach is driven by macroeconomic trends, demographic shifts, and deep local market analysis.

How does Trinity support intergenerational wealth planning and governance?

We help families create sustainable governance frameworks, educate rising generations, and build real estate succession strategies. Trinity’s experience with multi-generational families allows us to guide effective stewardship and long-term wealth preservation.

What differentiates Trinity’s real estate approach from other advisors or asset managers?

Trinity uniquely combines institutional-grade investment discipline with the relationship focus of a family office partner. Our clients benefit from unmatched transparency, aligned interests, and direct access to exclusive real estate co-investments, supported by over two decades of proven performance.

Can Trinity assist in building a portfolio of properties through direct ownership or partial equity participation?

Yes, Trinity specializes in sourcing, underwriting, and managing direct real estate investments on behalf of clients. Additionally, through our co-investment program, clients have the opportunity to hold partial ownership in select direct deals.

What is Trinity’s process for sourcing and vetting opportunities?

Yes. Trinity specializes in building tailored real estate portfolios through direct property investments and co-investment structures. We source, underwrite, and manage assets on behalf of our clients, enabling both full ownership and partial equity participation in select deals.

Do you offer advisory-only relationships or full asset management?

Yes. Trinity offers flexible engagement models ranging from strategic advisory-only relationships to full-service real estate asset and portfolio management, allowing clients to choose their desired level of involvement and oversight.

CONTACT US

We welcome inquiries from family offices, high-net-worth individuals, institutional investors, and the trusted advisors who support them. Use the form below to connect with our team and explore how Trinity Real Estate can help advance your real estate, succession, and strategic goals.

Clarity. Confidence. Results.